Read time 5 mins

Author Sophia 🌱

In the rapidly evolving digital banking landscape, one concept is emerging as a potential game-changer: Open Banking.

Open Banking is a transformative idea that promises to reshape how we manage our finances by offering consumers unprecedented convenience, choice, and control.

However, like any innovation of its scale, open banking also presents its challenges. This post will explore its opportunities and address the hurdles it faces, particularly within the US market.

At its core, open banking provides third-party financial service providers access to consumer banking, transaction, and other financial data from banks and non-bank financial institutions through application programming interfaces (APIs).

This kind of data sharing enables the creation of new financial products and services, enhancing competition and fostering innovation within the financial industry.

💡

Imagine an orchestra where each musician represents a different financial institution - banks, credit unions, mortgage companies, etc. Each musician is talented but can only create a single melody.Open banking is the conductor of this financial orchestra. Bringing together the music from each musician to create a harmonious symphony.

Open banking has its roots in the belief that the data held by financial institutions belong to the consumers, and they should have the freedom to share it with third-party providers of their choice.

This consumer-centric approach is what sets open banking apart from traditional banking practices, which typically put the power in the hands of banks rather than their customers.

Open banking works by utilizing APIs, which are essentially sets of rules that dictate how software components should interact.

These APIs allow different software systems to communicate and share information with each other securely and efficiently.

In an open banking context, APIs enable third-party providers to access a customer's financial data (with their consent), which they can then use to build and provide new, personalized financial services.

The rise of open banking is closely tied to advancements in fintech. Fintech companies, focusing on leveraging technology to enhance financial services, are often the third-party providers that make the most of the opportunities presented by open banking.

By utilizing the data shared through APIs, these companies can offer various innovative services, from more efficient payment solutions and better investment platforms to comprehensive financial management tools.

By embracing open banking, we're seeing a rush of new fintech businesses and consumer's are getting to experience next-level customer service and financial support.

While open banking has been adopted relatively swiftly in regions like Europe, due in large part to the Revised Payment Services Directive (PSD2), the US has been slower to jump on the bandwagon.

This is primarily because the US doesn't have a comparable regulation that mandates banks to open their data to third-party providers.

However, this doesn't mean that open banking is nonexistent in the US. Quite the contrary. Many banks and financial institutions already recognize the potential benefits of open banking and voluntarily provide third-party access to their data. But progress has been slow.

One significant development in the US open banking scene came back in 2020 when the Consumer Financial Protection Bureau (CFPB) began discussing implementing Section 1033 of the Dodd-Frank Act.

💡

Think of the CFPB as the group responsible for ensuring people are treated fairly regarding their money.In October 2020, the CFPB issued an Advanced Notice of Proposed Rulemaking regarding consumer access to financial records.

This notice asked for public input on effectively and efficiently implementing Section 1033 of the Dodd-Frank Act, which gives consumers the right to access their financial data.

Several years later, the CFPB is now experiencing increased demand to broaden its open banking rule to cover more data sets, including expanding it to include services such as mortgages, student loans, auto loans, and credit accounts, mandating that banks share financial data with fintech companies such as budgeting and financial management apps and online lenders.

Without this expansion, the types of data covered by the rule may exclude the kinds of services that provide the most benefit to lower-income people who have the most to gain by gaining a complete picture of their financial status.

Open banking offers many opportunities for banks, fintech companies, and consumers alike. Here are a few key opportunities that open banking presents:

🎉 Increased Competition and Innovation: Open banking fosters a competitive environment where financial institutions and fintech companies strive to offer the best services to consumers. This competition drives innovation, leading to the development of new and improved financial products and services that can significantly improve the lives of everyday people.

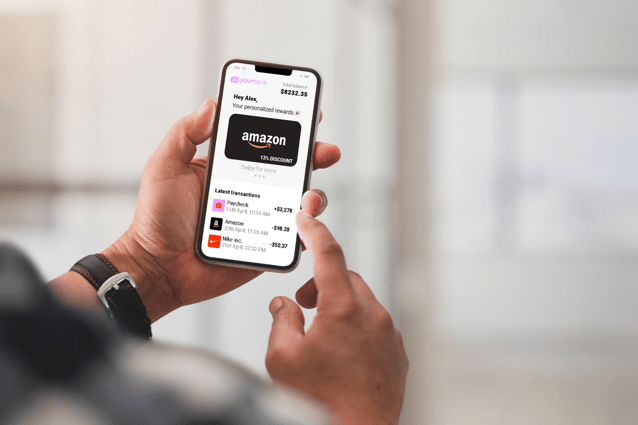

👏 Improved Customer Experience: With open banking, consumers can access a broader range of services that are more personalized to their needs. They can manage their finances more efficiently and make more informed decisions which also leads to a superior customer experience.

With total household debt in the US reaching $17.05 trillion in Q1 of 2023, there’s a desperate need for better financial transparency that open banking can provide.

📈 New Revenue Streams: For banks and financial institutions, open banking can also open up new revenue streams. Banks can monetize data assets and develop new business models by sharing their data with third-party providers. On the flip side, open banking also opens new revenue streams for fintech businesses that would otherwise lack the data they need to improve their products, apps, and services.

💸 Financial Inclusion: Finally, open banking also plays a significant role in promoting financial inclusion. As of 2021, an estimated 4.5% of U.S. households (approximately 5.9 million) were reported as “unbanked", which means that they do not have access to a bank account. By making banking and financial services more accessible and affordable, open banking can help bring the unbanked and underbanked populations into the financial mainstream.

Despite the promising potential of open banking, there are still several challenges that need to be addressed:

🔐 Data Security and Privacy: The sharing of financial data with third-party providers naturally raises some concerns about data security and privacy. Ensuring the secure transfer and storage of data is paramount, and it is essential that regulations are updated accordingly to keep consumer data secure.

👨⚖️ Regulation: In contrast to regions like Europe, which have implemented comprehensive open banking regulations like PSD2, the US is yet to establish a unified regulatory framework for open banking, which can create uncertainty for both financial institutions and fintech companies.

🔗 Interoperability: For open banking to function effectively, there must be a high degree of interoperability between different banking systems and third-party providers' systems. Achieving this can be a complex and slow-moving task.

🤝 Consumer Awareness and Trust: Lastly, many consumers are still unaware of the concept of open banking and its benefits. Building awareness and trust among those who will be using open banking is crucial for its success, but this, too, can take time.

💡

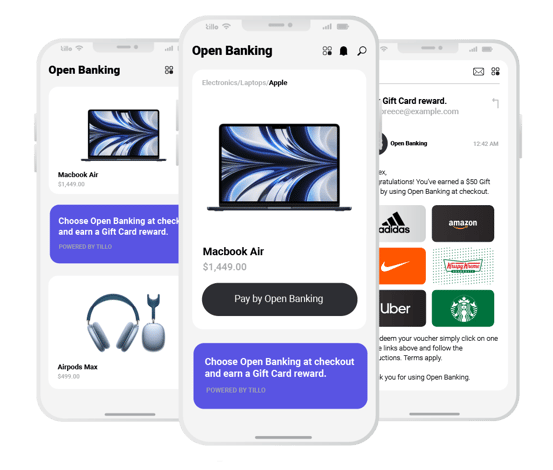

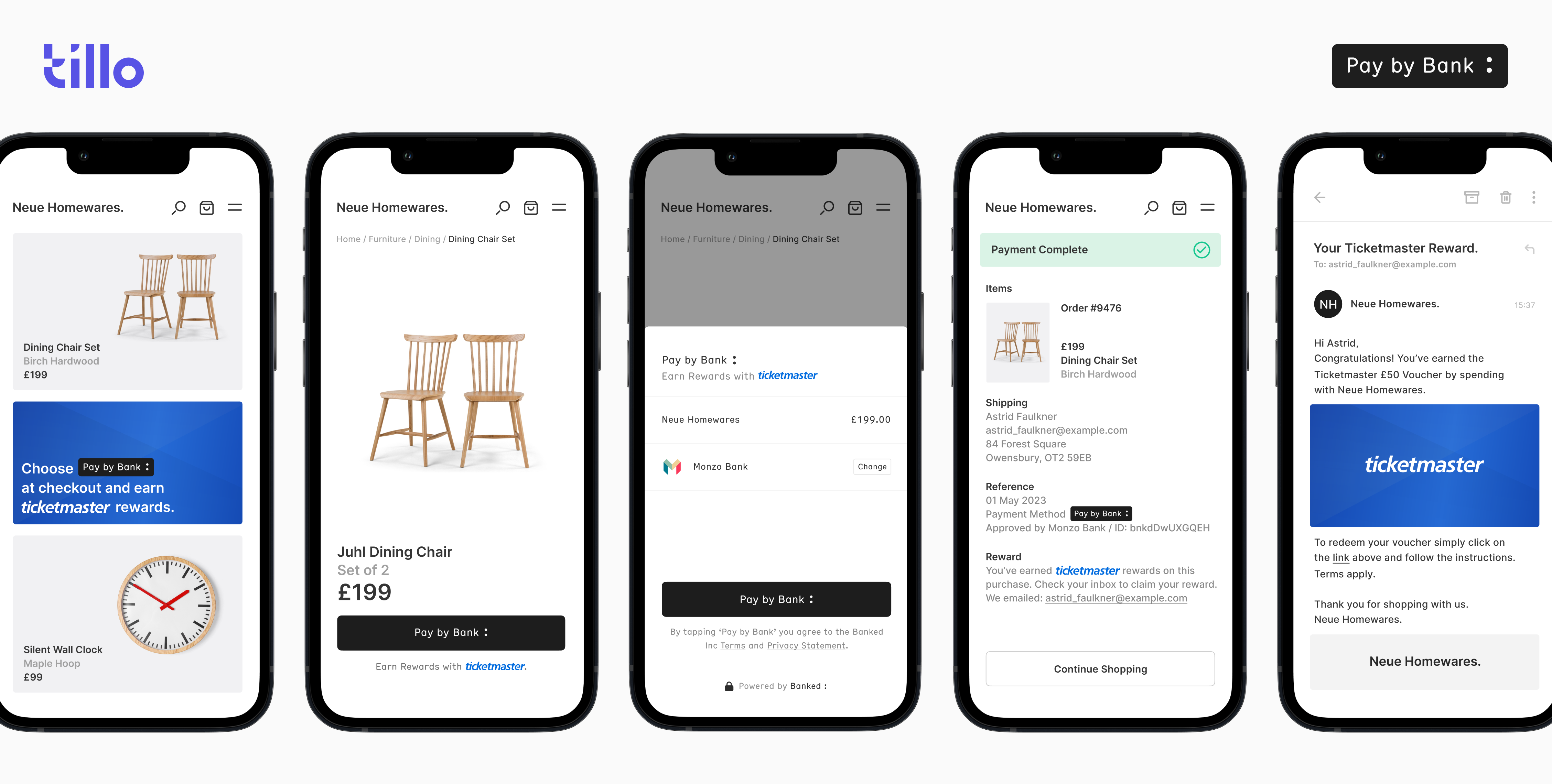

One of the quickest, most effective ways for businesses to encourage the adoption of their open banking initiatives is through digital rewards and incentives.

Banked :, a global payments network using open banking, saw its share of checkout rise from 10% to 23% by implementing digital rewards and incentives via Tillo's powerful gift card API.

The landscape of open banking in the US is at a critical juncture. Despite the challenges we've discussed in this post, the potential for transformative change in the financial sector is undeniable.

But what does this future look like? While some things may still be uncertain, here’s what we do know about the future of open banking in the US.

🏦 It will be a collaborative effort: The future success of open banking depends on the collaboration of banks, fintech companies, and regulators.

They must work together to establish comprehensive data security standards and protocols, addressing privacy concerns head-on and instilling consumer confidence in open banking services.

🚀 It will uncover a world of innovation: Banks and fintech companies must also continue to innovate, creating more refined, user-friendly platforms that offer real value to consumers.

By doing so, they can encourage wider adoption of open banking services and harness the opportunities it presents for revenue growth and improved customer experiences.

🎓 It all starts with education: Education will play a crucial role in the wide-scale adoption of open banking. Financial institutions and fintechs using open banking must educate consumers about its uses' benefits and the safety measures in place to drive adoption.

Open banking in the US is still in its early stages, and it’s clear there are significant opportunities and challenges on the horizon. While data privacy, security, and standardization hurdles are not trivial, the potential benefits of a more open, innovative, and customer-focused financial system are immense.

The journey towards a fully realized available banking system may be complex, but the potential is there for rewards and incentives to redefine the financial industry as we know it.

This is an exciting time in the financial sector - to find out how Tillo can help you take advantage of the opportunity, get in touch with us today.