Read time 3 mins

Author Sophia 🌱

It's becoming clear that traditional banks are facing stiff competition from innovative players known as neobanks, but besides curiosity for what’s new and fashionable, what are the real reasons why people are choosing to switch away from their traditional banks?

In this post, we’ll explore the real reasons why people are increasingly choosing to switch to neobanks over traditional banks, and some of them may not be what you think.

Neobanks provide a seamless and intuitive digital banking experience that allows users to manage their accounts, make transactions, and access financial services with ease right from their smartphones.

The average person checks their phone 58 times a day!

With user-friendly interfaces, quick onboarding processes, and innovative features such as real-time notifications and budgeting tools, neobanks offer a convenient and modern banking experience that resonates with today's tech-savvy customers.

With the average smartphone user checking their phone 58 times a day and millennials spending roughly 3.7 hours on their phones every 24 hours, it makes sense for banks to transition to a digital-first approach.

But it isn’t enough for banks to have a banking app; the app needs to be intuitive and responsive and offer real-time features that satisfy consumers’ growing need for personalized insights and instantaneous delivery.

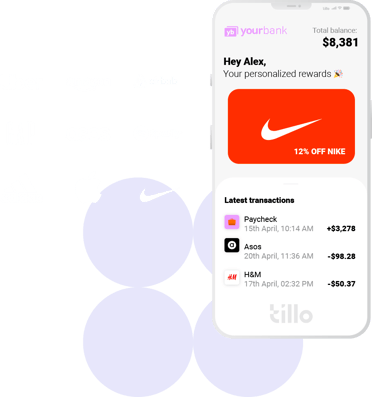

Neobanks leverage advanced data analytics and machine learning algorithms to offer personalized financial services tailored to the needs and preferences of individual customers.

From personalized spending insights and budgeting tools to customized savings goals and investment options, neobanks empower users with personalized financial management tools that help them achieve their financial goals.

Importantly, neobanks are doing this in a way that manages to captivate their users. Gone are the days of PDF bank statements; modern-day banking users want to see their data updated in real-time, they want it to be displayed visually, and they want it broken down by the categories that matter most to them.

Like it or not, traditional banks have earned themselves somewhat of a reputation for being formal, rigid, and oftentimes closed off. They may be secure, but they aren’t personable, and this simply doesn’t resonate with modern consumers.

Neobanks, on the other hand, manage to make themselves likable. They’ve built a huge following on social media and engage with their audiences as people, not customers.

Neobanks also champion transparency. They leverage the latest technologies, such as biometric authentication, encryption, and multi-factor authentication, to protect user data and transactions but are transparent in their policies, terms, and communications.

While some would never choose a bank based on the color of their bank card, the truth is that many young consumers do. Neobanks often offer cool-looking bank cards with unique designs that appeal to younger audiences who value aesthetics and individuality.

These visually appealing bank cards can be a factor in attracting customers, especially among the younger generation, who are known for their preference for unique and personalized experiences.

Whether metal bank cards, colorful bank cards, or a combination of the two, neobanks are making banking cool and sexy, and consumers love it. Couple this with their engaging apps, and the choice to switch is a no-brainer.

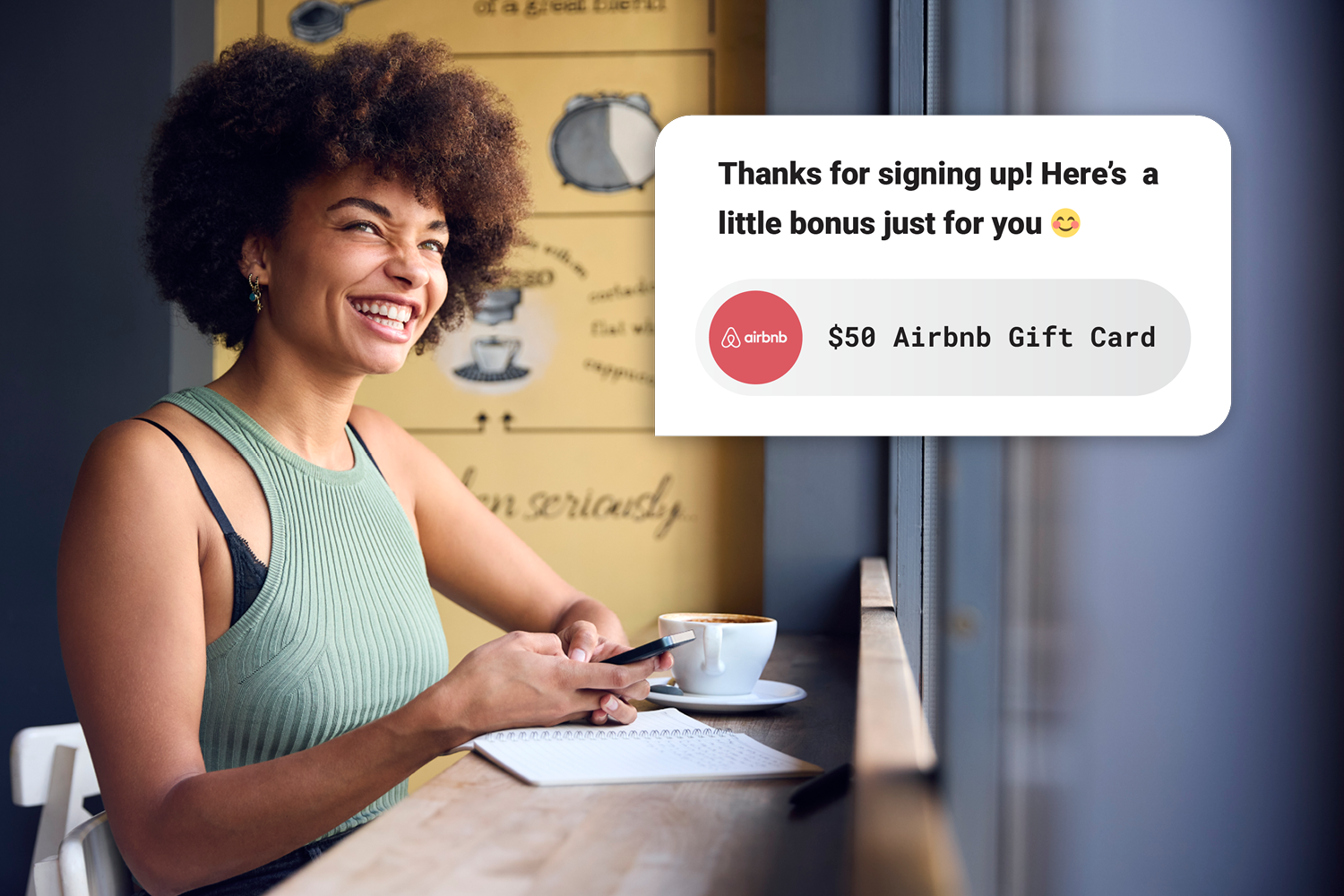

While sign-up bonuses are nothing new, neobanks are known for offering creative and unique incentives and rewards to their customers beyond the traditional cash lump sum usually given to account holders for making the switch.

92% of consumers trust referrals from people they know

From cashback offers and referral bonuses to exclusive partnerships and discounts, neobanks use incentives to incentivize customers to join, use, and refer others to their services, and they do so extremely effectively.

By keeping rewards and incentives on-brand, in-app, and personalized to their users, neobanks make themselves more attractive to potential customers, foster greater brand loyalty, and power efficient referral programs that people want to get involved with.

As the neobanking industry evolves, customer expectations are changing. Consumers now expect more personalized, convenient, and innovative services from their neobank. In the increasingly crowded neobanking market, neobanks must do more to stand out and attract, engage, and retain their customers.

Accounts and card-based payment services generate an estimated 70 percent of revenue for neobanks, leaving space for innovation and the discovery of new revenue streams.

Larger neobanks who have the size and financial means to test the boundaries of banking have the opportunity to evolve their apps to cover more of their consumer's needs.

By adding super-app components that extend beyond the realm of banking, they help to make themselves sticky while also building valuable revenue opportunities that help to make them more profitable and sustainable.

Products that can help neobanks boost their profitability:

🚀 Cashback

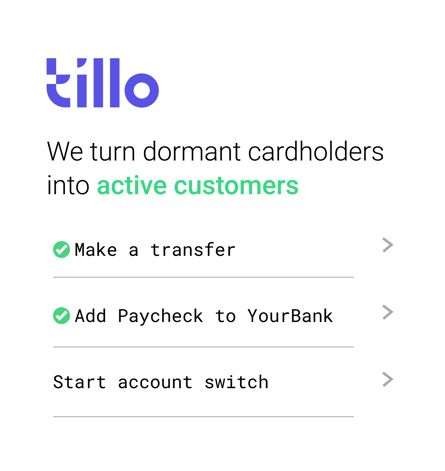

Tillo offers innovative neobanks and challengers a chance to tap into a game-changing rewards and incentives solution designed to drive customer engagement, loyalty, and profit.

If you're a neobank or challenger bank looking to take your customer acquisition, engagement, and loyalty to the next level, talk to Tillo today and unlock the power of digital rewards and incentives from 2000+ of the world’s most loved brands.