Read time 3 mins

Author Sophia 🌱

Embedded finance is revolutionizing how businesses operate, seamlessly integrating financial services into non-financial platforms for a more comprehensive, customer-centric experience.

In this evolving ecosystem, digital gift cards are emerging as a standout player, offering unparalleled personalization to meet individual customer needs and preferences; plus, they're not only effective – they're sustainable.

Embedded finance, at its core, integrates financial services into non-financial platforms. This means that consumers can access and use financial products and services, such as making payments, lending, or insurance, directly within non-financial platforms such as retail, travel, or even social media apps. 📲🏦

One significant advantage of embedded finance is that it allows businesses to monetize their customer relationships by offering convenient and relevant financial services. Not only can this improve customer experience, but it also increases customer engagement and loyalty, as the services being offered are more personalized and relevant to the customer's needs. 🙌

Embedded finance also presents several challenges for businesses, and the first is regulatory compliance. 👩🏽⚖️

Financial services are heavily regulated in most jurisdictions, and businesses must ensure they comply. Given that Open Banking and Embedded Finance are relatively new concepts, regulation is still catching up in many areas, making it tricky to stay on the right side of the line when the rules of the game are constantly changing.

The second challenge for businesses is security. 🚓

Financial services involve handling sensitive customer data, and businesses must ensure they have robust systems in place to protect their customers from fraud. Cybersecurity is a significant concern in the digital age, and data breaches can result in severe reputational damage and financial losses.

The third challenge is customer trust. 🤝

While consumers are increasingly comfortable using digital financial services, trust is still a significant issue. Businesses must ensure they build and maintain trust with their customers, particularly when handling their financial transactions and introducing them to new financial products.

Personalization is no longer just an added touch; it's a necessity. When done well, personalization extends beyond customer satisfaction and can also be used to boost customer engagement and loyalty.

Don’t believe us? Maybe these stats will help change your mind:

💡91% of consumers say they are more likely to shop with brands that provide offers and recommendations that are relevant to them.

💡80% of consumers are more likely to purchase from a brand that provides personalized experiences.

💡 72% of consumers say they only engage with personalized messaging.

💡 71% of consumers feel frustrated when a shopping experience is impersonal.

💡 63% of consumers will stop buying from brands that use poor personalization tactics.

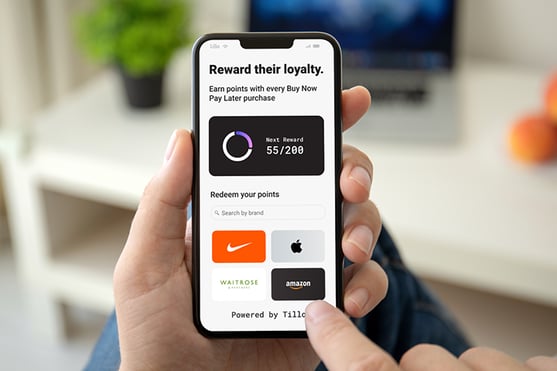

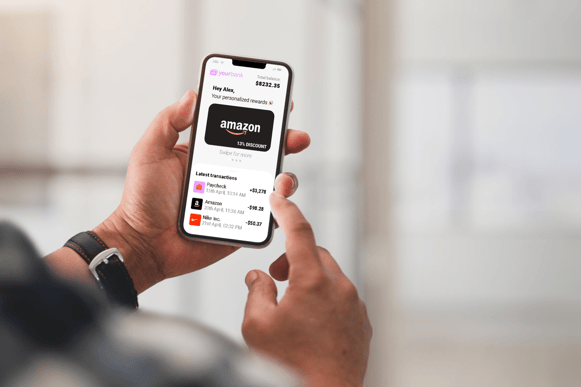

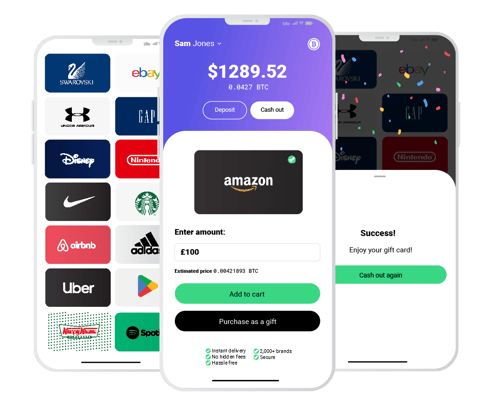

In embedded finance, digital gift cards are becoming a vital tool for customer engagement because they offer a high level of personalization that is difficult to match. Businesses can tailor digital gift cards to align with individual customer preferences, thus making them a highly effective incentive that their customers are willing to work for.

One of the easiest ways companies can personalize digital gift cards is based on the recipient's shopping history or known preferences. This not only makes the gift card more appealing to the recipient but also increases the likelihood of subsequent purchases - a win-win for the business and gift card retailer.

59%

of consumers end up spending more than the value of their gift cards

In addition to their effectiveness as an engagement tool, digital gift cards are also an environmentally friendly choice - making them the perfect option for eco-conscious businesses looking to appeal to younger markets.

of consumers admit to being more loyal to brands that show a commitment to addressing social inequities

Unlike traditional plastic gift cards, digital gifts don't contribute to plastic waste, and they are delivered electronically via email or directly into a customer's digital wallet, eliminating the need for any physical material. This not only makes digital gift cards a more sustainable option but also allows for instant delivery, something that modern-day customers have come to expect.

As the world of embedded finance continues to evolve, digital gift cards are set to play an increasingly important role. If you’d like to learn more about how Tillo can support your business with highly personalized digital rewards and incentives, contact us today.

We’re the fastest-growing global gift card network with 2000+ brands in 36 markets and 16 currencies 🚀