Read time 2 mins

Author Sophia 🌱

In the ever-evolving Buy Now Pay Later (BNPL) landscape, capturing and maintaining customer loyalty is no small feat. With a plethora of options available to consumers, it's more important than ever for BNPL providers to differentiate themselves from the competition - here’s where the magic of personalized rewards and incentives comes into play.

The growth and competitiveness of the BNPL market have made it clear that a one-size-fits-all approach to customer engagement is no longer sustainable. Consumers crave personalized experiences, and this extends to the rewards and incentives they receive.

of consumers say they’re more likely to be loyal to brands that demonstrate an awareness and understanding of their personal interests

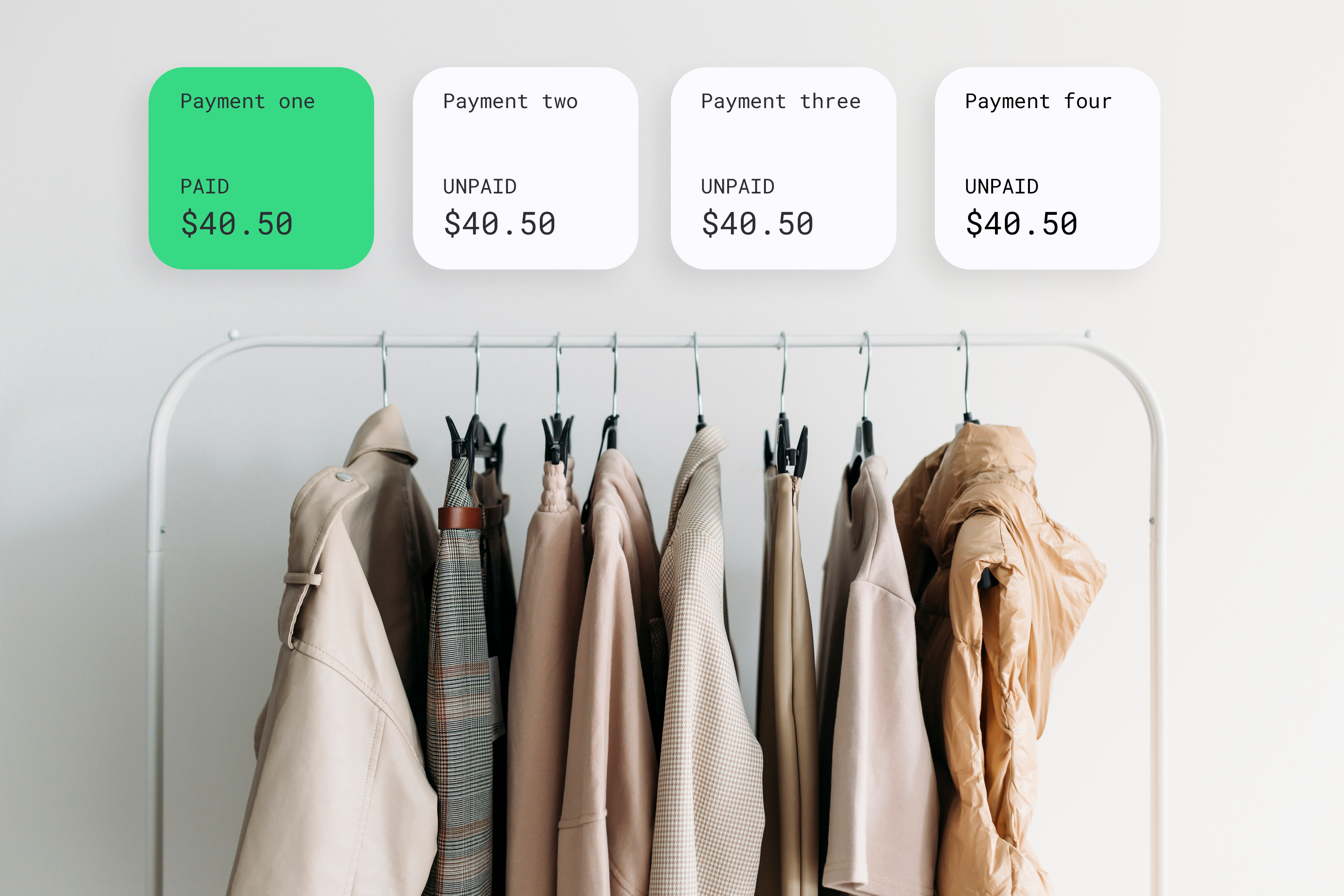

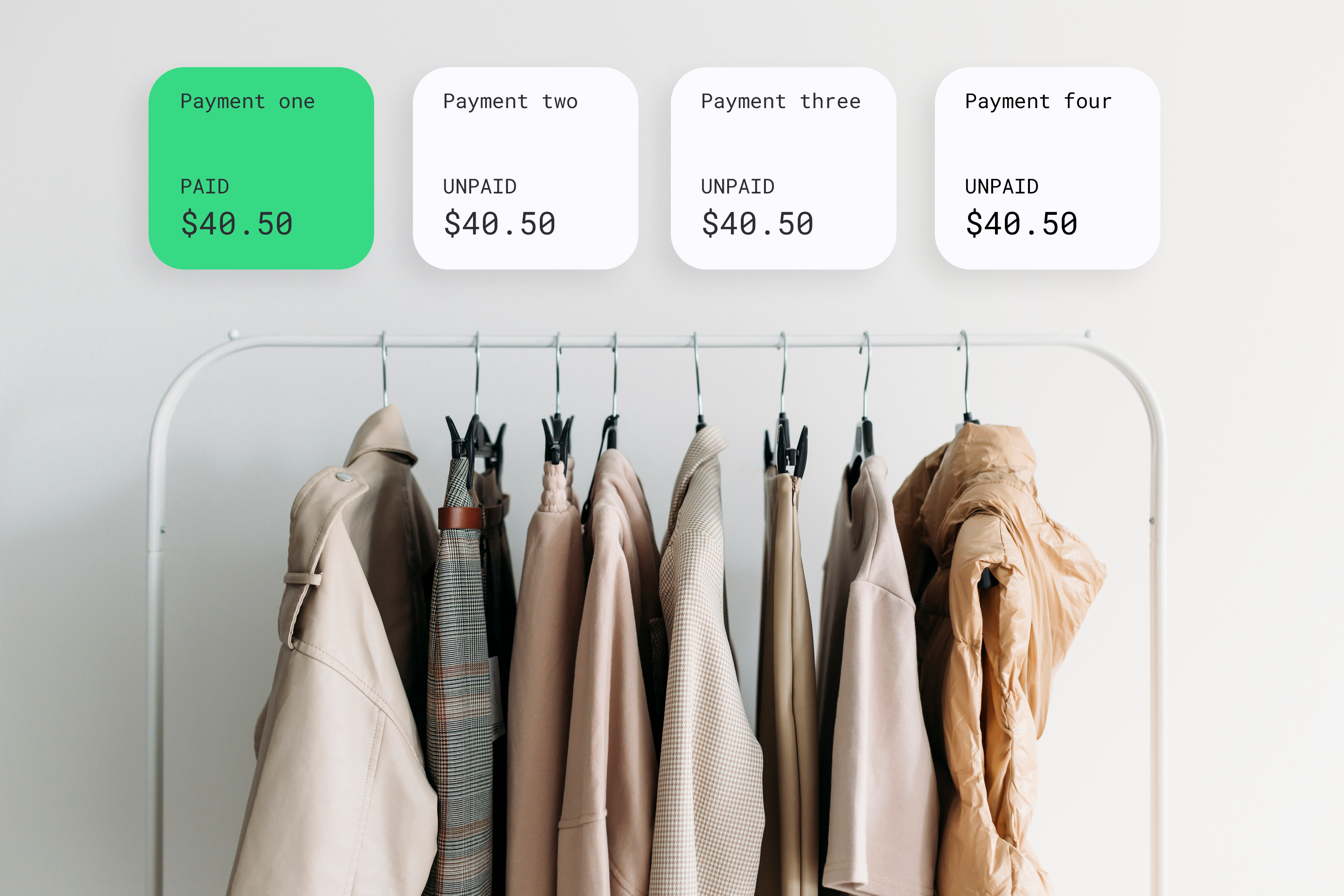

For BNPL businesses, personalization is key to standing out in a crowded marketplace. This is where Tillo's plug-and-go API and Choice Link products make a significant difference. With an array of more than 2000 global brands, Tillo enables BNPL providers to customize rewards and incentives to match individual customer preferences - whether they’re fine-dining foodies, tenacious travelers, or aspiring athletes.

At the heart of Tillo's offering is a commitment to making personalization easy and accessible. Our API seamlessly integrates into BNPL platforms, opening up a vast network of global brands for their customers to choose from.

Tillo's Choice Link product takes this personalization a step further. It allows BNPL businesses to curate a reward or incentive containing a list of brands personalized to the end recipient. This means that customers aren't just receiving any reward; they're receiving a reward that resonates with their unique preferences.

One of the world's leading BNPL platforms experienced the power of this personalization firsthand. By using Tillo's API and Choice Link products, they were able to reward their customers with an unrivaled range of brands they love, thereby boosting customer loyalty and increasing BNPL uptake.

The results of implementing personalized rewards speak for themselves. Our BNPL partner was able to scale internationally and across multiple currencies quickly and easily. Their loyalty program, powered by digital gift card content, has supported their growth on a global scale.

of consumers admit to spending more money to maximize loyalty points earnings

But the impact doesn't stop at growth. Personalized rewards and incentives also boost customer satisfaction and engagement. By offering rewards that are tailored to individual tastes, BNPL providers are showing their customers that they are valued and understood. This kind of personalized engagement strengthens customer loyalty and positions BNPL providers as a preferred choice over more established payment methods.

The future of BNPL is undoubtedly personalized. With Tillo, BNPL providers can leverage the power of personalized rewards and incentives to boost customer loyalty and differentiate themselves in a competitive market.

If you're ready to unlock the power of personalized rewards for your BNPL business, we're here to help. Get in touch with Tillo today to find out more about how our API and Choice Link products can help you delight your customers and grow your business.