A Tillo Webinar

The future of Fintech: a fireside chat with David Birch

Why connecting to your customer is the greatest opportunity.

David Birch

Author, advisor and investor in digital financial services

An internationally-recognized thought leader in digital identity and digital money, David Birch was one of the co-founders of Consult Hyperion in the 1980s and is currently a Director of the company.

David holds a number of board advisory roles and leads 15Mb Ltd (his advisory practice).

Ranking as one of the top 100 global fintech influencers of 2022 and a regular Forbes contributor, David is also the author of multiple widely-read books, including, Before Babylon, Beyond Bitcoin: From money we understand to money that understands us.

David has been named one of the top 15 sources of business information by Wired Magazine and was found to be one of the top ten Twitter accounts, followed by innovators, along with Bill Gates and Richard Branson. He is also a non-executive director at Tillo.

Alex Preece

CEO & Co-Founder of Tillo

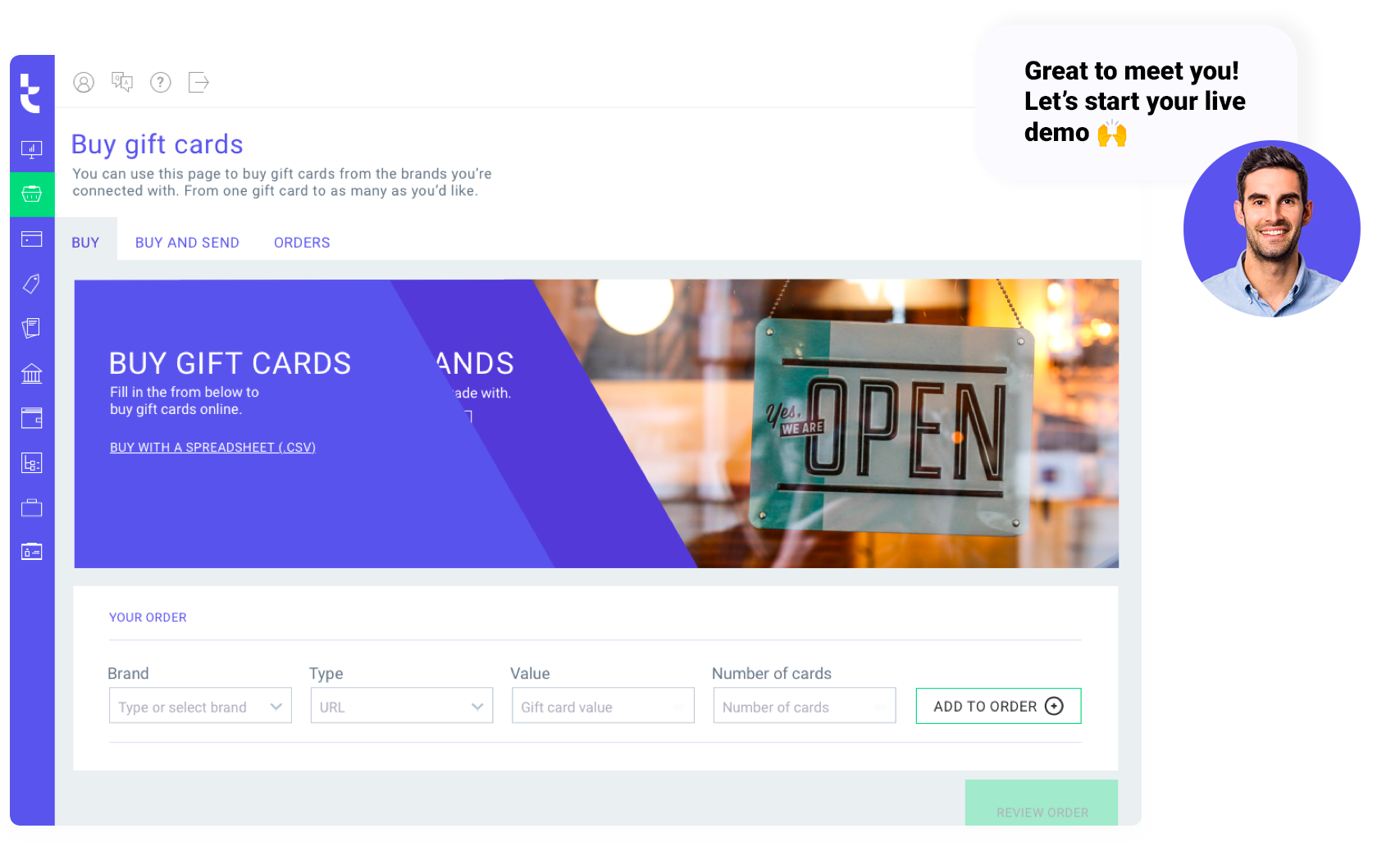

Alex Preece is co-founder and CEO of Tillo - a digital gift card platform powered by an award-winning API. Tillo connects the world’s most popular brands with fintechs and enterprises looking to acquire new customers, retain existing ones and unlock loyalty.

Alex started his career in the British Army and spent seven years jumping out of military planes and touring Bosnia and Iraq on active duty; since then, Alex has become a serial entrepreneur. He co-founded the UK’s first daily deal business, which he later sold to moneysupermarket.com, the world’s biggest comparison website. Along with his then-business partner, Gareth Gillatt, the pair co-founded Tillo in 2016.

Trading in 37 countries and across 16 currencies, Tillo is the industry innovator for digital rewards and incentives globally, processing more than $2 billion of digital gift cards to date.

What's covered:

-

What’s changed most in the industry over the last few years?

-

Which financial trends have been most surprising to David

-

The future of NFTs, crypto, digital currency, and open banking

-

What is digital identity, and why is it becoming more important?

-

How loyalty could drive the uptake of account-to-account payments

-

The evolution of Buy-Now-Pay-Later

-

And much more!